Damage to your home's foundation such as cracks and settling are both serious to the structural integrity of your home and costly to repair. It’s not uncommon to pay upwards of $15,000 for foundation repair depending on the severity of the damage and the method of repair. (Click here for foundation repair cost examples.) When it comes to homeowners insurance don’t be surprised if your insurance company doesn’t cover the damages.

It is important to check your policy for coverage benefits and limits. Poor construction or soil expansion and contraction are the most common causes for foundation damage and these causes are typically not covered by most insurance policies. The majority of insurance carriers deem that reasons that cause foundation damage can be avoided by controlling conditions that lead to inadequate drainage or flooding and by proper home maintenance. Typically, homeowner insurance policies only cover specific hazards. To find what your plan covers check the declaration page for details. Your repairs may be reimbursed up to your coverage limits if the damage to the foundation is because of a covered peril like a tornado, fire, or explosion.

Another thing to consider are warranties. Because homeowner’s insurance doesn’t cover damage caused by the use of poor materials or defective construction, it’s a good idea to check to see if you have a home warranty. Some home builders are offering warranties on foundation that cover the cost of labor, materials, and structural defects for up to ten years. This pertains to fairly new homes, so if this is you check to see if there is a warranty that is still valid and check it over closely to see what is covered. When buying a home it is important to have a professional inspect the foundation. This could save you a lot of hassle and money later by having the problems fixed before you purchase the home.

Adding supplemental coverage is also an option. It might be worth buying supplemental insurance to cover risks that are not covered by typical homeowner’s insurance policies, depending on where you live and the typical weather conditions. The majority of large insurance companies will offer a dwelling foundation rider for coverage of limited and specific risks like damage from water seepage or a burst water line. The majority of insurance companies also offer supplemental coverage for damage from floods, sewer backups, and earthquakes. On the other hand, damage from the foundation shifting, settling, or earth movement is typically not covered.

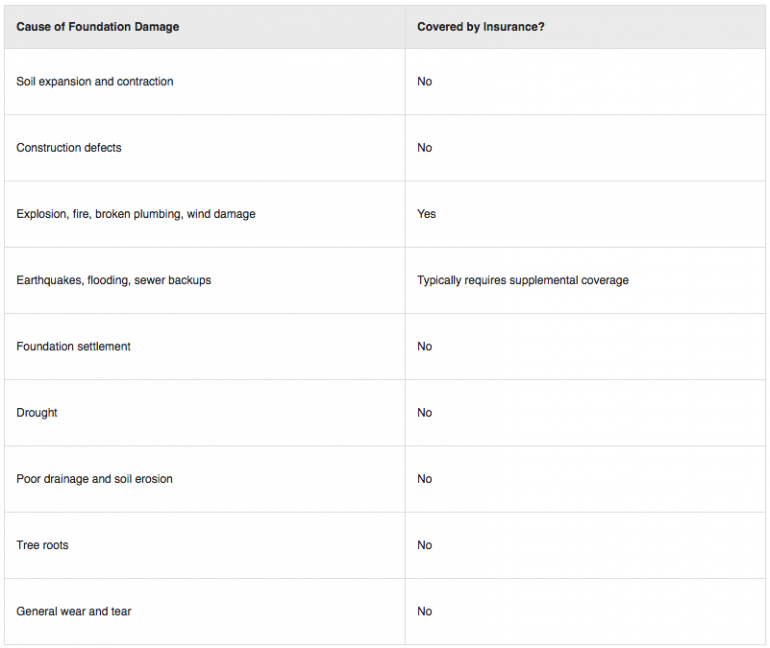

Being proactive and making early repairs are the best thing you could do if you notice any warning signs of damage. Fixing the problem early will save you from spending potentially a lot more money and more extensive structural issues later on. Also, if additional damage to your foundation that is from an issue that wasn’t repaired then the insurance company could deny repayment of costs for that claim. Click here for tips on hiring a foundation repair contractor. See the chart below for examples of typical insurance coverage for foundation damage.

There are so many creative and custom options for finishing concrete, but first and foremost important is the concrete itself. At Custom Concrete Creations we have state of the art equipment and a properly trained team with years of experience. Custom Concrete Creations is a premier contractor serving the Omaha area as well at the Midwest. Give us a call or send us an email for your custom concrete finishing needs today!

![]()